Manage withholding taxes, ledger and payment to government¶

A withholding tax, also called a retention tax, it is a government requirement for the payer of a customer invoice to withhold or deduct tax from the payment, and pay that tax to the government. In most jurisdictions, withholding tax applies to employment income.

With normal taxes, the tax is added to the subtotal to give you the total to pay. As opposed to normal taxes, withholding taxes are deducted from the amount to pay, as the tax will be paid by the customer.

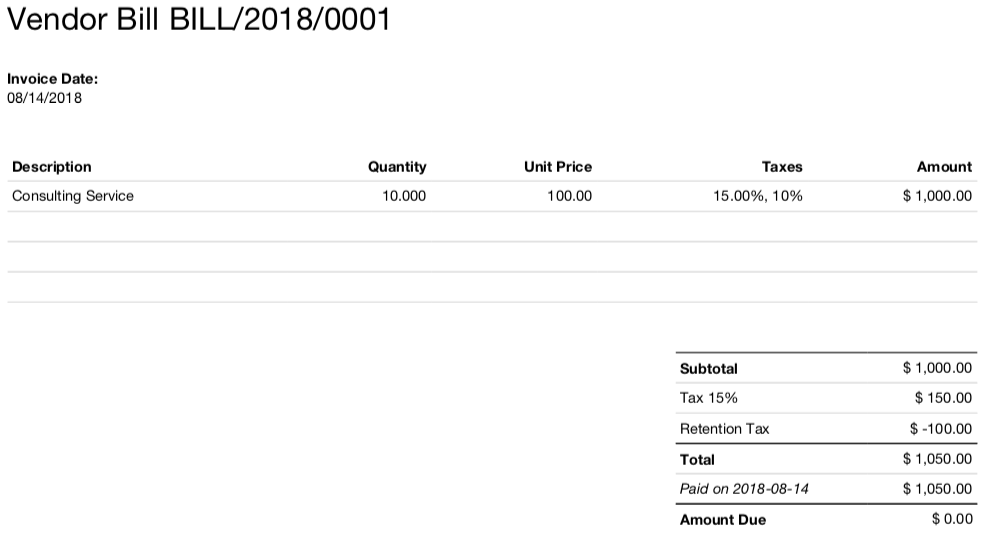

As, an example, in Colombia you may have the following vendor bills:

In this example, the company who sent the invoice was of 1000$ + 15% Tax the customer has to deduct the 10% tax and pay to the government.

Video¶

Access the video at https://www.youtube.com/watch?v=b23D98Vpf4w